BCCI rights impact News Corp's earnings from channels

MUMBAI: Star India?s acquisition of BCCI media rights for a whopping price has resulted in US media conglomerate News Corp?s international cable channels earnings contributions decline by 7 per cent in the first quarter ended 30 September from a year earlier.

Expenses at News Corp?s cable network programming grew by 11 per cent in part due to the BCCI rights. Star India earlier this year acquired BCCI media rights for Rs 38.51 billion for six years till 2018.

News Corp has reported total revenue for the first quarter of $8.14 billion, a $177 million, or two per cent, increase over the $7.96 billion a year earlier.

The revenue increase was led by 16 per cent growth at the company?s cable network programming segment, which was partially offset by declines at the company?s direct broadcast satellite television and publishing segments. The international affiliate?s revenue increase was boosted by Star India.

Cable network programming reported quarterly segment operating income of $953 million, a $178 million, or 23 per cent, increase over the prior year quarter, driven by a 16 per cent increase in revenue. Operating income contributions from the domestic channels increased by 33 per cent, led by growth at the Regional Sports Networks (RSNs), FX Network and Fox News Channel.

Strong local currency operating profit growth at the Fox International Channels was more than offset by the adverse impact of the strengthened US dollar and the impact of the inaugural broadcasts of the new BCCI cricket rights at Star.

About two-thirds of the international affiliate revenue increase reflects strong local currency organic growth at FIC and Star in India. The balance of the growth was from the inclusion of Fox Pan American Sports partially offset by the impact of strengthened US dollar.

Ad revenue at the domestic cable channels grew by eight per cent in the quarter over the prior year period, led by growth at the RSNs and Fox News Channel. The international cable channels? advertising revenue improved on a local currency basis but reported a one per cent decline from the prior year quarter, as the impact of the strengthened US dollar more than offset local currency growth at both the Fox International Channels, which benefitted from the consolidation of the Fox Pan American Sports network, and Star in India.

Expenses at cable network programming grew by 11 per cent in the quarter over the corresponding period in the prior year, due to increased programming costs including rights fees for the BCCI cricket in India, expanded Big 12 and PAC 12 college football coverage, the launch of the Ultimate Fighting Championship, as well as increased expenses associated with the consolidation of the Fox Pan American Sports network and the launch of new sports networks in Brazil and San Diego.

Film reported quarterly segment operating income of $400 million, $53 million higher than the $347 million reported in the same period a year ago. Quarterly results reflect the successful worldwide theatrical performance of ?Ice Age: Continental Drift?, which has grossed over $850 million in worldwide box office to date and is now the biggest animated film of all-time at the international box office.

Prior year first quarter film results included the successful worldwide theatrical performance of ?Rise of the Planet of the Apes? and the worldwide home entertainment performances of ?Rio? and ?X-Men: First Class?. The quarter also included increased contributions from the television production studios, including increased digital distribution revenue related to the timing of delivery of content to Netflix.

Television reported quarterly segment operating income of $156 million, an increase of $23 million versus the same period a year ago. This increase reflects a more than doubling of retransmission consent revenues and increased local advertising, driven by record first quarter political advertising revenues. These improvements were partially offset by lower national advertising revenues primarily reflecting lower primetime ratings and the market impact from the Olympics in August.

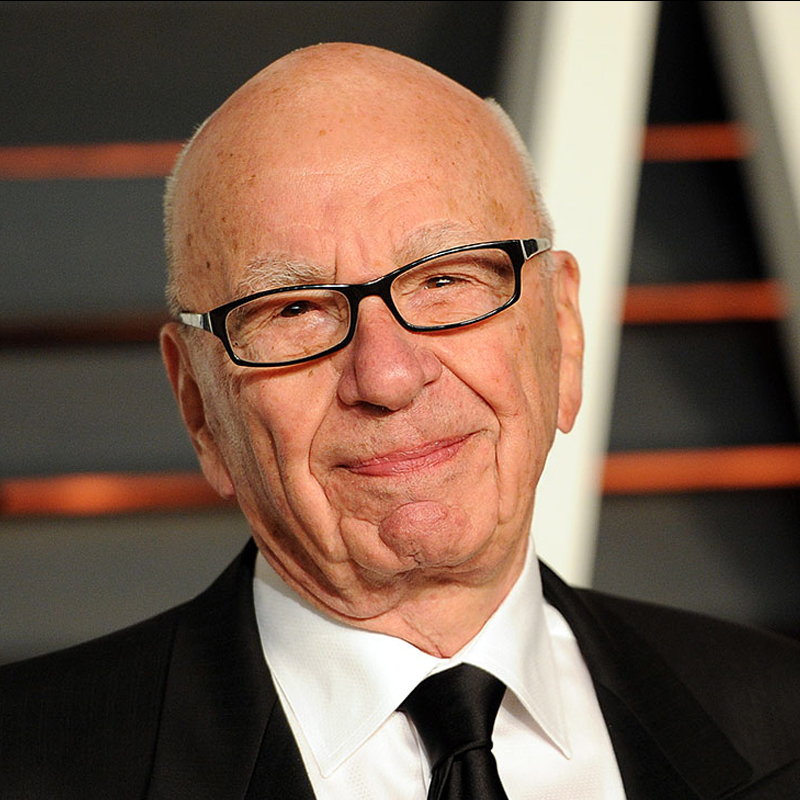

News Corp chairman, CEO Rupert Murdoch said, "Our operational discipline and focus on innovation continued to drive the company?s momentum in our fiscal first quarter, led by double-digit growth in our channels business and the global success of our film and television content. Even against considerable currency headwinds due to a stronger dollar, we were able to increase News Corp?s revenue and adjusted segment operating profit over the prior year quarter while continuing to make key investments to position us for future growth."

"We are committed to leading the change that the marketplace and our customers demand as the company builds on its success at leveraging multi-platform opportunities for our content. We believe that our ability to do so will be enhanced by the flexibility and management focus that will result from the proposed separation of our entertainment and publishing businesses. We have made considerable progress in this process and look forward to providing more details by the end of the calendar year."

Sky Italia generated quarterly segment operating income of $23 million, compared to $119 million of operating income reported in the same period a year ago. The decline was driven by higher programming expenses, including nearly $70 million of rights costs associated with the broadcast of the Olympics. This year?s quarterly results were also adversely impacted by the strengthened U.S. dollar. While reported U.S. dollar revenues declined, quarterly local currency revenue increased 1% from the corresponding period of the prior year led by higher subscription revenues. SKY Italia experienced a net reduction of approximately 40,000 subscribers during the quarter, bringing total subscribers to 4.86 million.

PUBLISHING

Publishing reported quarterly segment operating income of $57 million, a $53 million decrease compared to the $110 million reported in the same period a year ago, due to lower advertising revenues across all divisions, led by declines at the Australian and U.S. publishing businesses. The declines were partially offset by increased contributions at the U.K. newspapers, which benefitted from the launch of the Sunday edition of The Sun in February 2012, and at HarperCollins, which benefitted from the acquisition of Thomas Nelson, a Christian book publisher.