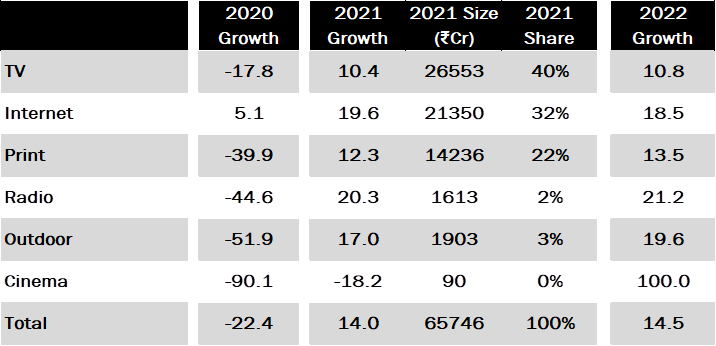

New Delhi: Advertising revenues swung back to a healthy growth rate of 14 per cent in 2021, rising from Rs 577 billion to Rs 657 billion. The growth is likely to accelerate further in 2022, with a 15 per cent rise in advertising revenue according to the Magna Global Forecasting Report released on Thursday.

While the digital ad formats grew by 20 per cent to Rs 214 billion this year, the traditional media rose 12 per cent. Ecommerce, Retail, Durables, Beverages, Pharma, Real estate, Finance, and Education remained the most active categories while automobile, government, personal care, and communication brands continued to hold back their spending.

TV to grow by 11 per cent to reach Rs 294 billion by 2022 end

Despite the Covid-led disruptions, television performed well in 2021 with original programming and Live sports events including the IPL and ICC T20 World Cup which boosted its revenue growth. With IPL media rights coming up in 2022, valuation this time is going to be even higher with the increase in the number of teams and the number of matches. With this factor, coupled with a few critical state elections, TV is expected to maintain momentum and grow by +11 per cent to reach Rs 294 billion by the end of 2022, according to the forecast.

Video and Social Media to lead Digital ad-spends

Digital advertising is currently the second-largest segment at 33 per cent market share. As per the forecast, Video and social platforms are likely to gain significant advertising share followed by audio and display. Overall, digital advertising revenues are expected to grow 18.5 per cent next year to top Rs 250 billion, as per the forecast.

Growth of print to be broad-based

In 2021, overall print grew +12 per cent from a low base (2020: -40 per cent), despite the slowdown in business. Growth has come from Retail, Durables, Finance, Real Estate, and Government spending. 2022 growth is expected to be broad-based, with most categories increasing spends and elections in a few large states helping to drive an increase of +14 per cent. With all Covid-19 restrictions lifted, the wedding season (which typically begins in October and lasts through March/April) will present another opportunity for print to thrive.

Radio to witness growth of 21 per cent in 2022.

Radio is expected to gain back the transit audience listeners lost during the lockdowns. Growth in both listenership and revenue is expected to come from tier 2 and tier 3 markets. Overall, radio advertising revenues grew +20 per cent in 2021 to reach ₹16 billion, nearly 70 per cent of the pre-Covid market size. Growth was driven by e-commerce, food, pharma, and retail advertising. Growth of +21 per cent is expected for 2022.

OOH growth to accelerate

OOH traffic numbers are already reaching pre-Covid levels, with passenger footfall in airports and the metro increasing rapidly. OOH, (digital & static, not including cinema) revenues rebounded by +17 per cent in 2021 and an acceleration (+20 per cent) is expected in 2022, with revenues reaching 67 per cent of 2019 pre-Covid market size at the end of the year. Automobile, real estate, OTT and finance are a few categories driving OOH advertising growth.

Major Sectors

According to the forecast, travel & hospitality will see a resurgence in 2022, with the relaxation in travel regulations. The automobile and handset sectors that experienced supply-side issues will bounce back, too, along with education, realty, retail, and fashion sectors. Traditionally TV-heavy categories, like FMCG, personal products, and food are expected to increase their share of digital advertising. Advertisers will also pursue every shoppable moment to offer “anywhere commerce” to their consumers. With local players in Reliance and Tata e-commerce platforms gaining more traction, the sector will further increase its share of advertising.

IPG Mediabrands India CEO Shashi Sinha said, “Waning fear of the virus, along with the opening of economic and leisure activities, has given a boost to demand and improved business sentiment. The Indian advertising marketplace is experiencing recovery and accelerated adoption of non-conventional methods by all forms of media to engage consumers is helping along the recovery path. Though the second Covid wave in 2021Q2 disrupted the momentum, ad revenue in 2021 will grow at a healthy rate after contracting -22 per cent in 2020

Follow Us

Follow Us