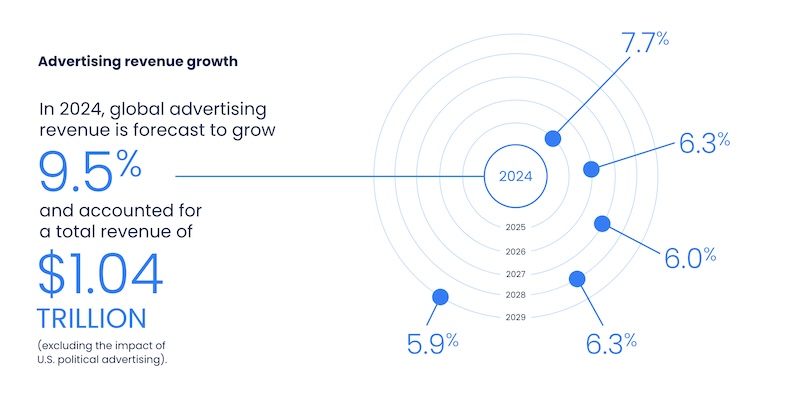

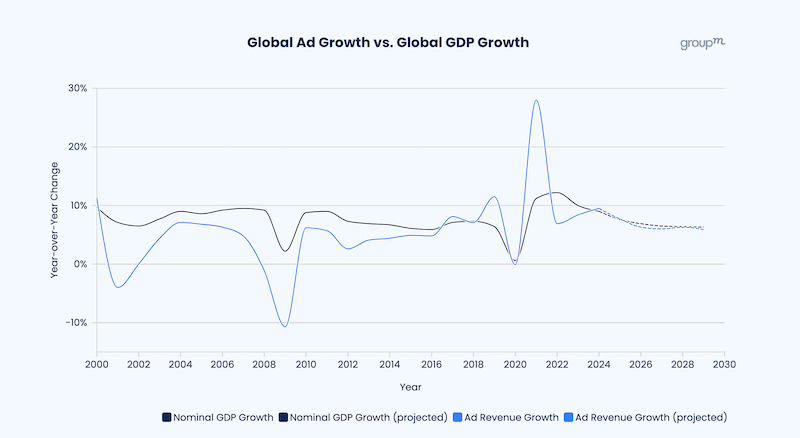

MUMBAI: GroupM, WPP’s media investment group, today published the topline findings of its End-of-Year Global Advertising Forecast for 2024. The report, which analyses advertising investments over the past 12 months and shares projections for 2025 and beyond, finds that strong performance of the largest sellers of advertising and increased digital expansion have propelled growth in global advertising investment to 9.5 per cent this year. The industry will surpass $1 trillion in total revenue for the first time in 2024 (excluding US political advertising) and grow another 7.7 per cent in 2025 to reach $1.1 trillion. Additionally, ad revenue growth will outpace nominal GDP growth in 2024 and 2025.

Pure-play digital advertising (excluding digital extensions of traditional media such as CTV and digital out of home - DOOH- but including YouTube and Tiktok) - remains the strongest channel and is estimated to grow 12.4 per cent globally in 2024 and make up 72.9 per cent of total advertising in 2025. It is expected to grow 10 points in 2025 to $813.3 billion. The steady growth till 2029 will see it capture 76.8 per cent of all spends.

TV remains the most effective form of advertising, according to research. Yet we forecast global TV (including both linear and streaming, but excluding political revenue) will grow just 2.4 per cent on a compound basis from 2024 to 2029, significantly slower than total advertising growth of 6.4 per cent. It is estimated to grow 1.9 per cent in 2025 to touch $169.1 billion.

Retail media continues to emerge as a rapidly expanding segment within digital advertising, is estimated to reach $177.1 billion globally in 2025, surpassing total TV revenue, including streaming, for the first time.

Out-of-home (OOH) advertising has maintained its share of the global advertising industry, largely due to the strong performance of its digital counterpart, DOOH, which is predicted to account for 42 per cent of total OOH revenue in 2025. Growth in 2025 is expected to be at at 7.2 per cent reaching $56.1 billion and accounting for five per cent of overall global ad spend. OOH has done better than any other channel in the face of the digital onslaught. It has almost certainly benefited from its “unskippable” nature in more recent years, its location-based value proposition, and its rapid digitalisation and innovation.

Global audio revenue will remain largely flat in 2025. But streaming audio will see double digit growth in 2024 and 4.4 per cent growth on a compound annual basis through 2029.. Traditional audio, however, will see its share drop from 1.8 per cent of global advertising in 2024 to 1.2 per cent in 2029 (although it will still account for more than 60 per cent of total audio ad revenue).

Print advertising, inclusive of all traditional and digital formats across both newspapers and magazines, will face further declines, dropping 4.5 per cent in 2024 and a further 3 per cent in 2025 to $48.1 billion. This medium continues to faces further declines, largely due to increasing digitization and the influence of AI. By 2029 their combined share will represent just 3.0% of total ad revenue, down from 10.7 per cent in 2019 and 35.1 per cent in 2009.

Cinema advertising is forecast to grow 5.2 per cent in 2024 and a further 5.9 per cent in 2025, though the $2.3 billion total will fall short of 2019’s $3.0 billion global figure. Some markets will have surpassed 2019 levels by 2025, but of the world’s five largest cinema ad markets, namely the US, Brazil, the UK, India, and south Korea, only Brazil will have completed its recovery by 2025.

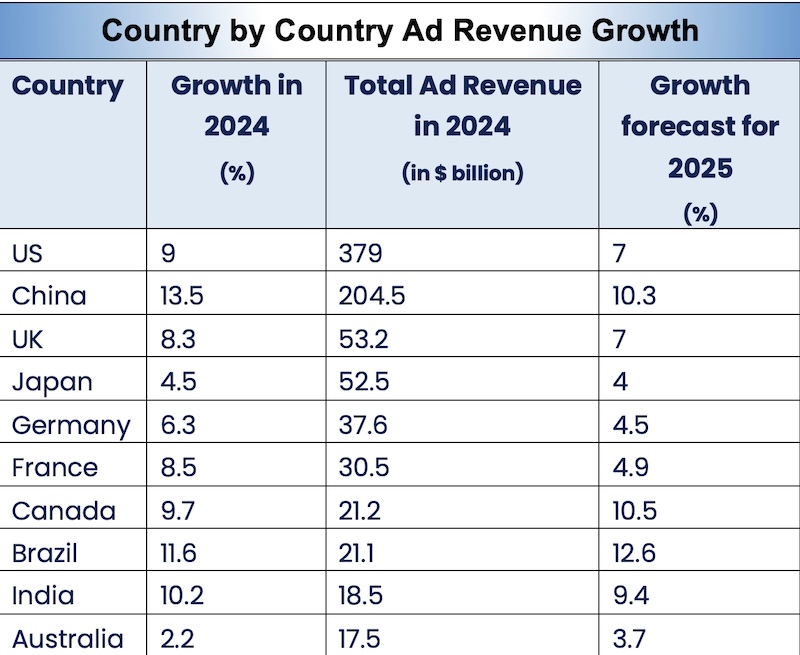

All top 10 advertising markets are forecast for growth in 2024, although to varying degrees. The US and China remain the two largest markets, with total ad revenue expected to grow 9 per cent to $400.2 billion and 13.5 per cent to $204.5 billion respectively. The UK remains in third place, just ahead of Japan. Germany and France maintain their rankings, followed by Canada, Brazil, India and Australia.

On artificial intelligence the Group M report say that it is s a multiplier of technology and creativity, not a driver of advertising growth in and of itself. Brands are often rewarded by shareholders for touting their use of the technology to increase efficiency and improve productivity. Yet consumers are more fickle, at times embracing its uses and at other times decrying them. Brands that lean into the obvious direction of travel toward more AI while ensuring it remains ethically responsible are likely best positioned over the long

term to capitalize on the effects.

The Group M report also gave some insights of the main advertising categories:

CPG: In a world preoccupied with conflict, technology, and an increasingly algorithmically driven media diet, CPG brands are looking to identify and align with cultural moments to help drive brand differentiation and sales growth. While media consumption has shifted in some part to online, and social channels in particular, the impact of TV (including both linear and streaming) is likely to retain its importance for CPG brands as companies look to drive both long-term brand health and near-term purchases. the median advertising intensity (advertising expense as a percentage of revenue) is at 5.3 per cent.

Digital endemics: In 2017, nearly a decade ago, the median advertising intensity (advertising expense as a percentage of revenue) for this group of companies was more than 19 per cent invested to a large extent on digital channels by in-house teams. Over the last two years, a focus on profitability amid rising interest rates and an increasing reliance on brand storytelling by the now “establishment players” has led to some growing pains and a sector-typical willingness to test, innovate, and make big bets. The median advertising intensity currently stands at 12.8 per cent.

Retailers: While the biggest companies in this group, including Amazon, PDD and Walmart, have continued to report strong GMV growth, others (especially smaller, more nationally focused brick-and-mortar players), have sounded the alarm on consumer cautiousness and slowing sales. These companies may be able to offer an in-store experience the e-commerce players can’t, but some marketers may find it challenging to differentiate their store’s offerings across a range of more digital touch points. The median advertising intensity for this category stands at 0.8 per cent.

Media and entertainment: The outlook for the year ahead does appear more positive than when we penned last year’s report. Streaming platforms at Disney, WBD, Paramount, and Netflix have all turned quarterly profits, and losses are narrowing at Comcast, ITV, and others. Revenue growth accelerated in Q3 of this year for all segments other than music, with positive growth in all segments (the first time that has been true since Q1 of 2022). However, linear TV’s gains from having the U.S. elections, the Olympics, the Copa America, and the Euros all in the same quarter are unlikely to be sustainable going forward. The median advertising intensity for this category stands at 5.9 per cent.

Automotive: Automotive advertisers are now caught in a similar situation to media companies. The writing seems to be on the wall as to future emissions requirements and the transition to battery powered and hybrid cars (similar to the shift to streaming). But the economics haven’t yet caught up and the competitive field for electric vehicles is much more fragmented than that of traditional combustion vehicles. Newer players like Byd are offering cheaper EVs and at the same time investing in coveted sports sponsorships like the UEFA Euros tournament in summer of 2024. The median advertising intensity for this category stands at 7.4 per cent.

Financial services: Because of compliance issues and integration complexities, the industry has been slow to avail itself of a host of new offerings that other sectors have adopted, including retail media networks, social media, and influencer marketing. Partly due to a renewed (and necessary) focus on brand building, companies in the sector continue to make significant investments in audio, TV, and sports sponsorships. Economic uncertainty and the growing distrust of traditional financial institutions further complicate the landscape, creating both opportunities and challenges for tech-forward financial brands. Balancing brand building with performance marketing and navigating compliance requirements are likely to remain key areas of focus. The median advertising intensity for this category stands at 1.9 per cent.

Technology: The rapid pace of innovation is forcing adaptation on the part of tech advertisers. B2B brands are shifting to more digital marketing-led strategies, adding complexity to existing measurement and reporting. Digital channels are increasingly seen as critical to reaching new generations of consumers (whether for consumer or enterprise products), but as competition heats up, differentiation is challenging. Brand building continues to rely on sports, though advertisers are finding the space crowded as more sectors look to sporting events for scaled reach and cultural relevance. The median advertising intensity for this category stands at 2.1 per cent.

Pharma: Every industry is in a constant state of evolution and flux, but healthcare may rival advertising with the pace and magnitude of external factors driving change for the sector. Populations are aging and environmental and dietary factors are rapidly influencing future health outcomes (and future healthcare and pharmaceutical needs). And, in a recurring motif from this year’s report, competing successfully in a rapidly evolving industry can be complicated by internal divisions, regional and local nuance, and lagging technological integration. The median advertising intensity for this category stands at 2.8 per cent.

Luxury: Luxury advertisers have experienced significant volatility by region over the last four years. Consumption has flagged in China this year, and organic growth has slowed in North America as well. The APAC region, excluding Japan, has declined in the last three quarters for most companies reporting such a segment. Outperformance in Japan likely has more to do with a weaker yen and travelers from China, especially, looking for deals, implying a more transactional and price-conscious luxury consumer in 2024 and 2025. The median advertising intensity for this category stands at nine per cent.

The report concludes by saying that the advertising industry is hurtling through a rapid evolution brought on by the pervasive use of AI and an ongoing shift to digital channels. Pureplay digital advertising, projected to surge 12.4 per cent in 2024 and 10.0 per cent in 2025, is solidifying its dominance, representing 72.9 per cent of total advertising revenue in 2025 and a projected 76.8 er cent by 2029. This digital dominance, however, is accompanied by increasing scrutiny and regulation, creating a complex environment for marketers to navigate.

While the narrative of television's decline persists, its effectiveness remains undeniable. Despite this, global TV revenue, including streaming, is forecast to grow at a more modest 2.4 per cent compound annual rate from 2024 to 2029, significantly trailing overall advertising growth. This divergence underscores the need for marketers to pursue a balanced approach, leveraging all the tools and channels available to meet both performance and long-term brand goals.

(The visual was generated using Canva. No copyright infringement is intended)

Follow Us

Follow Us