Mumbai: GroupM has released its ‘This Year, Next Year’ global end-of-year forecast that shows a much faster expansion in the advertising industry than previously anticipated (driven primarily by growth in the US, UK, and China). India is among the top ten markets that are expected to grow between six to eight per cent annually, on average. Digital advertising accounted for 64.4 per cent of all advertising in 2021, up from 60.5 per cent in 2020, even as the big tech firms such as Alphabet, Meta and Amazon accounted for 80-90 per cent of the global total.

In the top ten advertising markets, including India, growth should get back to the mid-to-high-single digits over the next five years, predicted the global report.

Digital advertising is likely to end 2021 on a high, growing by 30.5 per cent, up from June’s forecast of 26 per cent growth, estimates the global agency.

Television advertising, on the other hand, is forecasted to grow by 11.7 per cent in 2021, up from June’s estimate of 9.3 per cent. Given 2020’s decline of 13.7 per cent, the industry is not expected to return to 2019 levels until 2023. The report predicts that subsequent years will be roughly flat—up 1-2 per cent per year through 2026—for television advertising in most major markets around the world, as the largest advertisers continue to incrementally shift spending.

Overall, Connected TV+ will account for about 10 per cent of total TV advertising in 2022 ($17 billion of a total of $171 billion) and is expected to double by 2026.

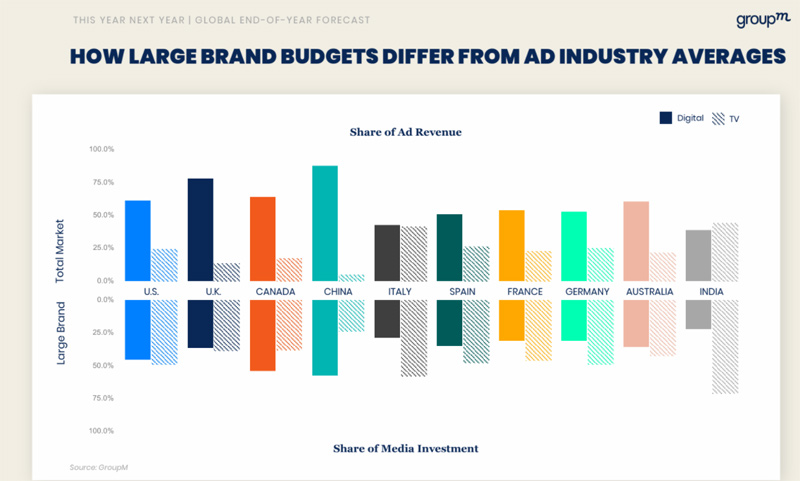

TV still typically accounts for nearly half of large marketer budgets, incrementally down over time. A superficial read of the data included in 'This Year, Next Year' might leave one with the impression that because 64 per cent of the world’s advertising revenue is generated by digital media and 21 per cent goes to TV, that marketers are allocating 64 per cent of their budgets to digital media and 21 per cent to TV, on average. This would be a mistaken interpretation because many advertisers—especially small ones and those whose businesses operate entirely online—often allocate all or nearly all of their budgets to digital media while large businesses typically allocate higher shares of their budgets to television.

Audio advertising which took off in the pandemic is expected to grow 15.6 per cent in 2021 and 6.4 per cent in 2022. In subsequent years, however, group m assumes a reversion to historical trends: largely flat.

OOH advertising, which took a beating in most major markets during the pandemic-induced lockdowns, is expected to grow 17.1 per cent in 2021 and 14.9 per cent in 2022. In subsequent years, the report predicts a reversion to historical trends: mid-single-digit growth.

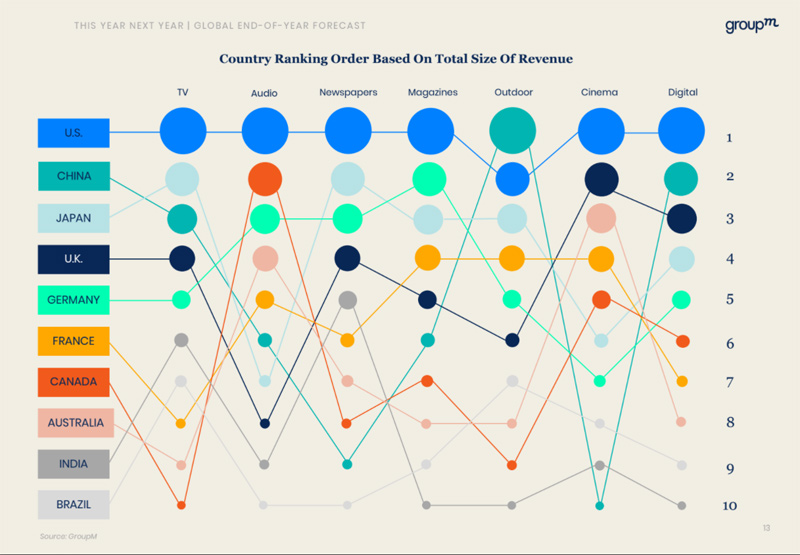

Many underlying trends appear to be disproportionately concentrated in the US, the UK, and China, which together account for approximately 70 per cent of all the industry’s growth, despite making up about 60 per cent of the total market, says the report.

Some of the key global factors causing faster-than-expected growth are new small businesses allocating greater resources to nationally oriented digital advertising, China-based marketers capitalizing on low-cost international shipping and using global digital platforms to reach overseas consumers, and app developers or other 'digital endemic' businesses rooted in the internet economy, many of which focused on advertising-driven top-line revenue growth