Mumbai: Infrastructural challenges like the massively low penetration of high-speed internet connections and miniscule cord cutting limit the scale of CTV in India to 0.5 million homes, or five per cent of India’s TV universe.

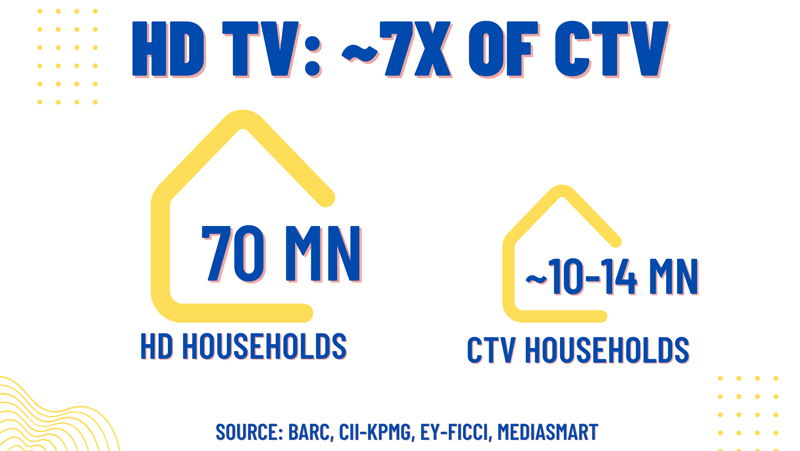

The scale of CTV in India has been a concern for advertisers and has not been able to play up to the hype around it. Not just CTV, but advancement of technology in developed markets from computers, to internet, to smartphones have always brought disproportionate hype to India much before they could become scalable. CTV is witnessing a similar reality check in India, as has been unravelled by credible industry reports over the last year. As per reports published by CII & KPMG, EY-Ficci and MediaSmart, CTV penetration in India ranges between 10-14 million homes, which is less than five per cent of India’s TV universe.

Factors behind the lack of scale for CTV in India

A very miniscule number of smart TVs in India are CTVs. The penetration of wired broadband in India that drives high-speed connectivity to power CTVs is currently limited to 12 million homes as per a Trai report in 2022 and has witnessed significantly sluggish growth post-pandemic.

The absence of cost arbitrage for OTT platforms vis-à-vis pay TV subscriptions is another key factor that is likely to keep CTV growth modest.

Cord cutting in India as per the recent CII-KPMG report is limited to merely 0.5 million homes, 0.2 per cent of the overall TV universe that currently stands at 226 million homes.

HD channels dominating premium audience viewership with a scale close to 7x of CTV

Premium audiences among India’s TV universe have been seeking high-quality viewing experiences on pay TV which has been largely addressed by their shift to high definition (HD) TV channels. Viewership of HD channels has grown rapidly to reach a base of 70 million homes covering over 25 per cent of the TV universe. This six-fold reach of HD TV in comparison to CTV is demonstrative of its far superior capability in reaching out to premium audiences. In fact, 95 per cent of CTV homes in India are HD homes. TV consumption on HD channels is a key distinguishing characteristic of premium audiences beyond ownership of cars & premium smartphones.

Nine out of 10 HD homes watch sports on HD channels

Sports viewership on HD TV is massive, with nine out of every ten HD TV homes watching sports on HD channels. This exhibits the choice of sports fans seeking the very best viewing experience via HD channels. A Kantar research showed that nearly two thirds of sports viewers preferred HD channels due to better audio/video quality as compared to CTV. Half of sports viewers on HD channels also cited easier navigation and the absence of lag/ delay, which further illustrated the superior viewing experience perceived relative to CTV. The decision to watch live sports on CTV isn’t influenced by preference but rather a tendency to utilise existing OTT subscriptions. Pay TV has retained its status as the most preferred platform for watching live sporting content even in developed markets with high penetration of paid OTT platforms such as the US. The Super Bowl, which is a megaevent in the US, witnessed 9x higher viewership on TV as opposed to digital, showcasing that when it comes to consumption of live sports, TV is the way to go for viewers.