MUMBAI: Five weeks into the new TRAI tariff regime, there seems to be some shift in viewership patterns and consumer choices. According to Chrome LIVE data, pay channels witnessed a drop of 24 per cent from week 4 to week 9 in 2019. On the other hand, FTA channels saw a spike from 21 per cent to 26 per cent in the same time span.

Prior to the implementation of the new tariff order (NTO), DPOs and broadcasters were mostly operating on a fixed fee model. However, the new regime is showing a significant impact on the channel reach, channel share, ratings of non-driver channels and the overall revenue.

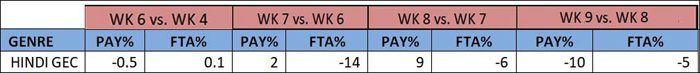

Major fluctuations were seen across national channels over the last couple of weeks including Hindi GECs which saw a drop ranging between 0.5 to 10 per cent for pay channels and 0.1 to 5 per cent for FTA channels.

Some passable changes enumerated in week 7 by way of reversal of the impact on connectivity of channels – exponential loss on pay had somewhat reduced owing to multiple operators putting on channels as per the old package after having switched them off. The same has also had an effect on FTA which had seen a spike.

The second week of NTO extension continued seizing changes at PAN India level which earlier was a 3 per cent gain for pay and 5 per cent gain for FTA channels in Chrome DM’s week 7 data which in week 8 changed to 5 per cent and 4 per cent gain respectively.

Some more interesting changes as the NTO appendage concluded its third week on ground with pay channels registering a drop of 6 per cent owing to changes in channels’ connectivity across Free Dish and FTA gaining 2 per cent across the standard definition channels in Chrome DM week 9 data.

The key to address these challenges for securing the correct revenue share amongst other things would entail consumer education, constant monitoring of consumer preferences and realignment of the bouquet packaging strategies taking into account consumer preferences.

Under the new regime, consumers have the option of paying only for channels they want to watch and can drop other channels from their list and hence, the subscriber base will now solely depend on the communication between the DPOs and the end consumer, and in the event of any communication gap, the last mile consumer will not subscribe to the channels and these may result in significant erosion of subscriber base impacting the revenue of DPOs and the broadcasters.

Follow Us

Follow Us