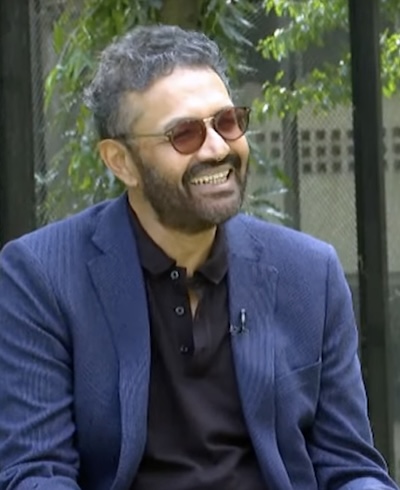

It’s been 11 years since Varun Berry has been serving as managing director of food company Britannia Industries. Since then, the designation of vice-chairman has been added to his titles. But a lot more has happened at Britannia: its product portfolio has significantly expanded beyond biscuits into adjacent categories like dairy, cakes, rusk, and croissants. He has focused on driving innovation, strengthening distribution networks particularly in rural areas, and implementing robust cost efficiency measures.

Prior to joining Britannia, Berry had a long stint at PepsiCo, where he held various leadership positions including CEO of PepsiCo Foods for Greater China. He also served as CEO of PepsiCo's Indian snack food business.

Berry is known for his strong operational expertise and focus on execution. During his tenure, Britannia has consistently improved its market share in the biscuits category while maintaining healthy profit margins despite inflationary pressures. He has emphasised direct distribution expansion, particularly in rural markets, and driven premiumisation across product categories.

His management style focuses on systematic improvements in distribution, cost management, and innovation. Under his leadership, Britannia has also made significant investments in new manufacturing facilities and automation to support growth.

Berry recently made a presentation after the company’s Q3 and nine month 2025 financials as well as answered investment analysts’ questions. Excerpts from the presentation and question and answers sessions..

On the macro environment.

It's been quite challenging. Food inflation was nearly in double digits, with cereals up 6.5 per cent and oils and fats around 15 per cent. The government's GDP projections show real GDP growth at 5.4 per cent and nominal at 8 per cent, though they're forecasting a recovery to 10.5 per cent in the second half.

On inflationary pressures on input costs and on managing them.

We're seeing palm oil up 43 per cent, cocoa up 103 per cent, flour up 4 per cent, and corrugated boxes up 15 per cent. Overall commodity inflation is about 11 per cent. It would have been 2-4 per cent higher if we hadn't done forward buying. Sugar has remained flat, and laminates saw a nominal three per cent increase. We have been forward buying of key commodities, getting in manufacturing efficiency improvements, optimising procurement, improving Logistics, keeping overhead cost under control, and managing employee cost -targeting 0.75x of revenue growth, optimising work capital limit usage and using capacity strategically.

On Britannia’s growth relative to the industry

Based on the exit numbers and public declarations by other companies, we're performing ahead of the industry. Our core biscuits business grew about 5.5 per cent in volume terms, with total volume growth at 6 per cent, showing the positive impact of our adjacency businesses.

On the approach to different segments

We're taking a multi-tiered approach. For our core product, biscuits, we have launched premium cookies with new variants like fruit & nut, butter, jeera. We have maintained popular price points with grammage management. We have ringfenced our core products and are very clear we will be protecting market share by innovating in existing segments. In our premium offerings we have launched Britannia Pure Magic Choco premium offerings. There are new premium croissant variants, an upgraded cake portfolio and premium cheese.

In the value segment, we have introduced Rs 5 packs for Rusk and our focus has been on maintaining competitive pricing while strategically managing grammages.

On brand investments.

We're focusing on several areas: Critical growth brands, innovation-led initiatives, higher impact social media activation, tactical consumer promotions, digital campaigns showing strong consumer connection, premium segment emphasis, regional preference consideration, and brand strength maintenance against competition.

On growth in adjacency businesses

We're seeing strong momentum. Croissants will cross Rs 200 crore next year, milkshakes have already crossed Rs 200 crore and are growing high double digits. 17 per cent contribution from e-commerce

We've launched new products like a dual-flavoured layer cake, a Rs 5 pack in rusks, and a triple chocolate croissant. In drinks, we've introduced Winkin' Cow Grow, a Rs 20 flavoured milk fortified with 16 nutrients.

On the cake portfolio.

We're in the midst of a full cake portfolio relaunch with new graphics and improved recipes that are outperforming competition. We have launched a triple chocolate variant. Similarly, we're rolling out a relaunch of our entire cheese portfolio. These relaunches are backed by new graphics and superior recipes. Our cheese is beating competition in taste tests.

On the company’s approach to the salty snacks category.

We're being very deliberate here. While we recognise it's a large category, it's also highly competitive. We're running pilots in some markets, experimenting with different formats, marketing approaches, product specifications, working on advertising pull vs push, on pack sizes and grammage, and on consumer preferences. We'll only launch nationally when we're absolutely confident of sustainable success.

On the company’s advertising strategy

We're focusing on critical growth brands and innovation, with increased emphasis on high-impact social media activation. This approach is delivering better productivity for our advertising investments

On competitive pressures, particularly from new entrants

While we're aware of new entrants, including large players, we believe brand strength is crucial in this category. Price alone isn't sufficient for success, and our established brands have consistently maintained their position despite competitive pressures.

On Britannia’s e-commerce strategy

We've developed in-house capabilities for data-based consumer insights and personalised content. E-commerce contribution varies significantly by category - about four per cent for biscuits, 17 per cent for croissants, nine per cent for cakes, and 11 per cent for dairy products. It's particularly effective for new product launches.

On the company’s approach to innovation

On the company’s approach to innovation

We're taking a measured approach. For instance, our Pure Magic Choco Frames with Harry Potter themes, launched exclusively for e-commerce and modern trade, is performing exceptionally well. We're focusing on innovations that can be sustained and scaled.

On distribution initiatives

We're implementing several strategic changes. For urban retail, we have a five-part strategy: leveraging high-potential outlets, right-sizing service frequency, upskilling salesmen capabilities, upgrading technology for better productivity, and increasing feet on street. We're also planning a refresh of our rural route-to-market approach. Direct distribution has been increased to 2.88 million outlets from 2.79 million. Then rural distributors have expanded to 31,000 from 30,000. We are also laying greater emphasis on focus states with distribution growing at 2-2.5 times the average.

On growth in the focus states.

They contribute about 15-16 per cent to our overall revenue and are growing at 1.3-1.4x the company average. These states represent 35 per cent of the rural category, and our market share there is less than half of what we have in the rest of the country, so there's significant headroom for growth.. Following distribution-led, brand-led growth strategy. No big bang pricing strategies. Focus is on sustainable growth through execution excellence

On the capex outlook

We're taking a break after significant investments. Planning to keep it between Rs 150-200 crore annually, unless volume growth demands more. We have three new plants with new lines and sufficient capacity headroom, so we're well-positioned for now.

On the outlook on margins

While we don't give forward estimates, we're confident about managing the current challenges. The 6-6.5 per cent price increases, combined with our 2.5 per cent cost savings target and other efficiency measures, should help us maintain our profit margins. We've navigated similar environments successfully in the past.

On the company’s approach to cost leadership

Our cost savings programme has evolved significantly. In 2013-14, it represented 0.7 per cent of revenue; now it's at 2.5 per cent. We reset these targets annually - whatever is achieved ends with the year, and we start fresh with new initiatives each April.

On the company’s ESG initiatives

We've received recognition from Times Now for ESG impact and a silver award from Scotch ESG awards. We've run a successful campaign highlighting our achievement of 100 per cent plastic neutrality, energy efficiency, and water stewardship.

On managing the price-point products given the inflation

A: For popular price points like Rs 5 and Rs 10, we're carefully managing grammage while ensuring consumer value. We're also introducing new price points where relevant, like our Rs 20 Winkin' Cow Grow product, which helps us tap into new market segments.

On the company’s international business

The international business continues to perform well across markets. While we don't break out specific numbers, it's showing consistent growth and remains a focus area for us.

On employee costs fluctuations.

We had a Rs 75 crore impact in Q3 related to stock appreciation rights, based on share price movements. Last quarter had a Rs 50 crore provision, and Q1 had about Rs 25 crore. These fluctuations are based on share price changes - when the share price moved from Rs 6,338 to Rs 4,762, it impacted the provisions.

On the approach to technology and digital transformation

Several initiatives are underway: we are developing e-commerce capabilities in-house even as we are taking a data-based consumer insight approach. We are producing a lot personalised content along with the automation of sales force and digital tech upgrades. Tools have been put in place to enhance productivity and platforms where consumers can engage have been built. Digital campaigns are being managed on these platforms and outside.

On pricing strategy in FY 2025 as against FY 2023

Initially, we thought it would be a deflationary year and had actually taken some price decreases. Then the inflationary trend emerged. We were also hopeful that government duties on fats would be temporary, but as the finance minister clarified, these are here to stay as part of the effort to indigenise fats in India. Now we're taking decisive pricing actions. We're implementing a three-phase price increase totalling 6-6.5 per cent: two per cent already implemented, 2.5 per cent being implemented; Q1 FY26: 1.5 per cent planned. This is calibrated to address the 11 per cent commodity inflation while maintaining competitiveness.