MUMBAI: The Super Bowl isn’t just a football game; it’s a national viewing party. Year after year, the event attracts record-breaking TV audiences, and in 2024, Super Bowl LVIII took the crown as the largest single-network telecast in history. But sports co-viewing isn’t just about the ‘Big Game’. According to a new Nielsen report, nearly 47 per cent of all TV viewing in the U.S. happens with at least one other person—be it friends, family, or even a few strangers at the bar.

However, while co-viewing is easy to understand, it isn’t always easy to measure. Many media planners still rely on outdated, flat co-viewing factors—estimates like "1.2 viewers per TV screen at 2 pm and 1.5 at 8 pm”. As TV audiences become more fragmented, this approach is no longer enough. Sports programming offers a clear example of how outdated these assumptions can be.

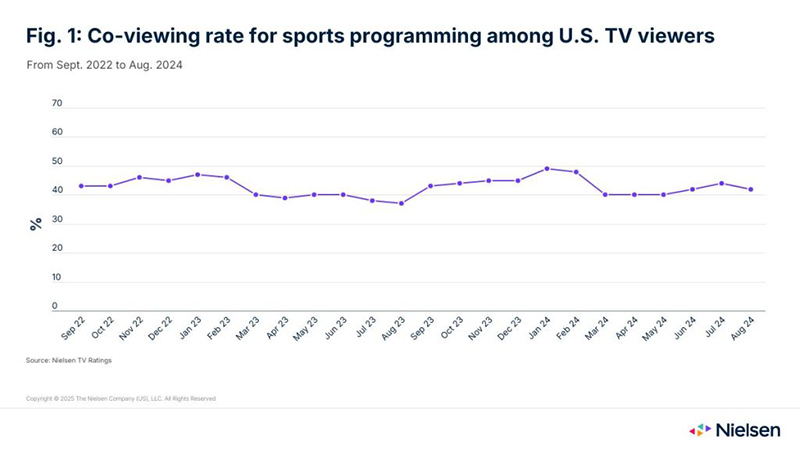

Nielsen’s data from September 2022 to August 2024 highlights the dramatic month-to-month variations in co-viewing rates. Co-viewing rates ranged from 37 per cent in August 2023 to nearly 50 per cent in January and February 2024—just in time for major sporting events like the Super Bowl and Copa América.

Interestingly, even high-profile global events like the FIFA World Cup and the Women’s World Cup saw lower-than-expected co-viewing in the U.S.. The reason? Time zones matter. When matches are scheduled in the middle of the night or early morning, it’s harder to gather a crowd—no matter how exciting the event.

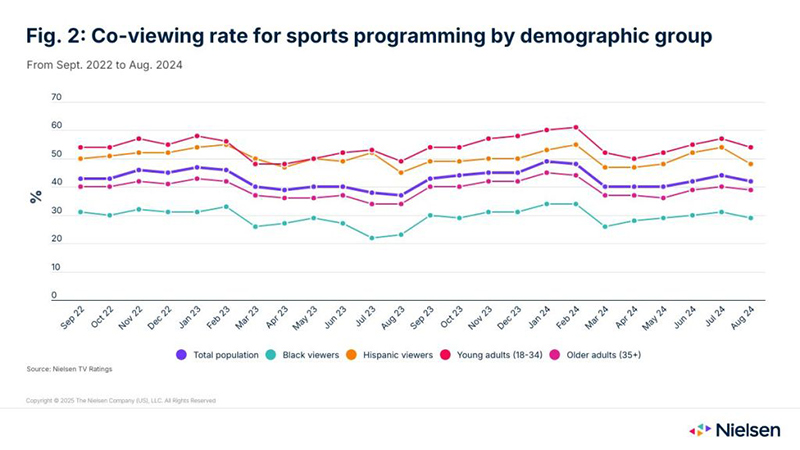

The study also uncovered significant co-viewing gaps across different demographic groups. Over the two-year period, Hispanic audiences had a 20-point higher co-viewing rate for sports compared to black viewers. Age also played a role—younger audiences were more likely to watch in groups, while older viewers tended to watch alone.

Household size matters, but so do social habits. Hispanic families tend to have larger households, leading to more natural co-viewing opportunities. Younger audiences, meanwhile, are more likely to watch sports together at bars or with friends, even though they watch less traditional TV overall.

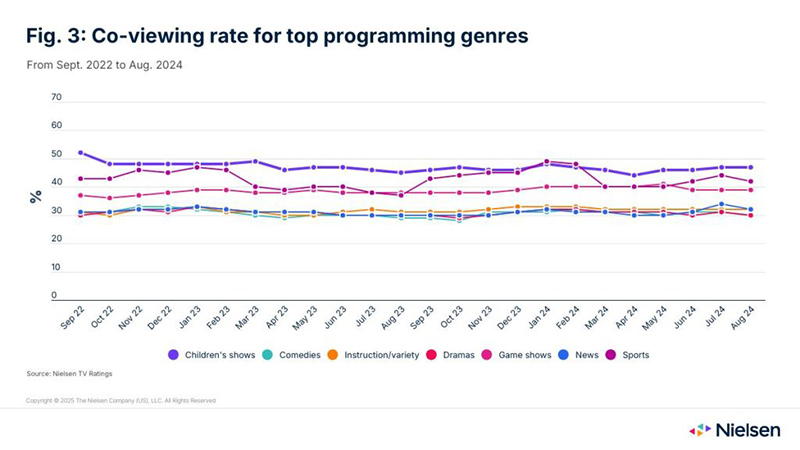

How does sports programming compare to other genres? The answer might surprise you.

Children’s programming actually had higher and more consistent co-viewing rates than sports. Not shocking—kids rarely watch TV alone. Game shows also saw strong co-viewing growth, benefiting from streaming platforms that have introduced the genre to a younger audience. Meanwhile, news, dramas, and variety shows hovered just above the 30 per cent co-viewing mark.

What can advertisers and media owners take away from these insights? Flat co-viewing factors are outdated. While sports programming shows how drastically co-viewing fluctuates, other genres also have their own subtle, audience-specific variations.

For advertisers, targeting a specific demographic or advanced audience means relying on real-world co-viewing data rather than static estimates. If your strategy still assumes fixed co-viewing multipliers, it’s time to update your playbook.

For media owners, understanding whether people watch alone or with others can directly impact content creation, monetisation strategies, and advertising sales. If you know who’s watching together, you can optimise your programming accordingly.

In a world where TV audiences are fragmented across platforms and devices, one thing remains clear: co-viewing is here to stay—but you need the right data to make the most of it.