Mumbai: Most common reasons for video revenue loss for publishers in India range from factors including inventory control, underutilisation of video advertising, traffic quality and not taking advantage of the latest technologies available.

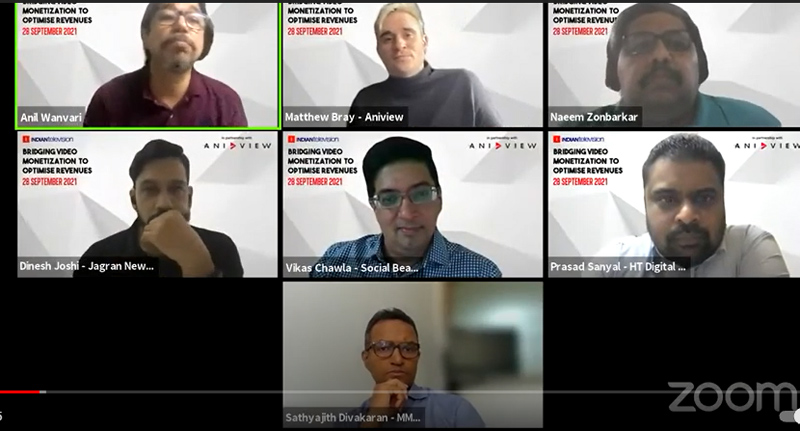

Some of these issues and their solutions were discussed during a webinar- ‘Bridging Video Monetisation to Optimise Revenues’ organised by Indiantelevision.com in association with Aniview on Tuesday. The virtual panel discussion was moderated by Indiantelevision.com Group founder, CEO, and editor-in-chief Anil Wanvari.

Experts discussed, how better content experience, fuller transparency, a self-service platform with better control on the video player, along with having an experienced team to operate the platform could drive higher revenues.

According to end-to-end video advertising and monetisation solutions provider Aniview, business director-APAC, Matthew Bray, currently India is the fastest-growing internet advertising market in the world, and video remains the most popular ad format. “It’s the sixth-largest market in consumption of video ads,” said Bray about the video advertising landscape in India.

Amongst the reasons for the loss in video revenue, Bray cited poor content experience, heavy player, player loading issues, inventory loss, lack of transparency on traffic insights among others. Non-adherence to Google policies and underutilisation of Google Adx are other primary causes of video revenue loss, Bray said. “Many publishers in India leak video revenue & underutilise their own video content on a regular basis,” he said, adding that full control over a video player can lead to an increase in revenue. “Google will likely remain the dominant SSP for video."

According to HT Digital's Prasad Sanyal, underutilisation of inventory plagues almost all publishers in India. “We are looking at avenues where we can have more control over our video assets & monetise them better,” he added.

By running a video player in these placements publishers can make better use of their own video content to engage their users and create more ad opportunities. While it not only allows full control over ad placements, player behaviour, and ad breaks, it leads to the creation of better quality traffic that drives higher CPMs. When deployed correctly this can even lead to significant revenue lifts. Aniview cited Jagran as a successful case study, as it has more than doubled its revenue on some ad placements on article pages by deploying Aniview.

“With Aniview we got a white label solution. There are the cities, and tier-2, tier-3 segments too, for all of which we need to create separate segmentation as per the category,” shared Jagran New Media, AVP and head-ad monetisation and strategic partnership, Dinesh Joshi. “We also produce a lot of text content, but definitely video is going to be big in the near future. Jagran is working on branded content on the video side, we have to work on the monetisation front too.”

HDFC Bank, vice president, and head- digital marketing, Jahid Ahmed, said, regulations apart from basics like viewability can give a lot of confidence on rolling out a video across platforms. Also, the decision on which video is to be used where- that also plays a significant role, he added.

Social Beat co-founder and director Vikas Chawla highlighted the need to scale up the inventory for advertisers to see it as a viable option to do large campaigns.

“Most of us have invested in analytics significantly, but we have a long way to go before advertisers get comfortable with us,” added HT Digital Streams’ Prasad Sanyal.

Manorama Online’s general manager (digital) Sathyajith Divakaran shared, "We have an OTT platform which is exclusively video-led and we only encourage video ads. We are clear in what we can offer as ads as we know which shows attract a certain kind of audience. It is just that the video inventory available is not utilised fully despite having a number of partners on board.”

According to Matthew Bray, Video is going to keep growing in India & in order to sell the inventory created one needs to have a system that they can properly control. “Then you see better yields and more video views because you can control the content,” he said, adding that there are exchanges in India that are having trouble moving video content because there isn't enough inventory being created.

Sharing that increasingly they are evolving to a point where they know what to do with their inventories, HT Digital’s Sanyal said, “At HT we are getting to a stage where we should be able to drive more revenues out of videos & also do better videos in the process. We hope to deliver better value to our readers and viewers."

HDFC Bank’s Jahid Ahmed said that every platform is evolving in its own space and it’s great to see such platforms coming up that helps publishers in their cause. He added, “It's right to outsource such expert work instead of all platforms trying to do everything by themselves. For discoverability of our product-led videos, if some platform smoothly integrates with our CMS & gives good info to our users, then why not,” added Ahmed.

Talking about the near future Ahmed said, “Digital is growing significantly at 35 to 40 per cent Y-O-Y, and within digital, video-led content consumption is one key aspect we are focused on. Video along with a combined vernacular, with personalised elements like geography/ gender, is the way to go.”

All the panelists were in agreement on the significance of video content in today’s times.